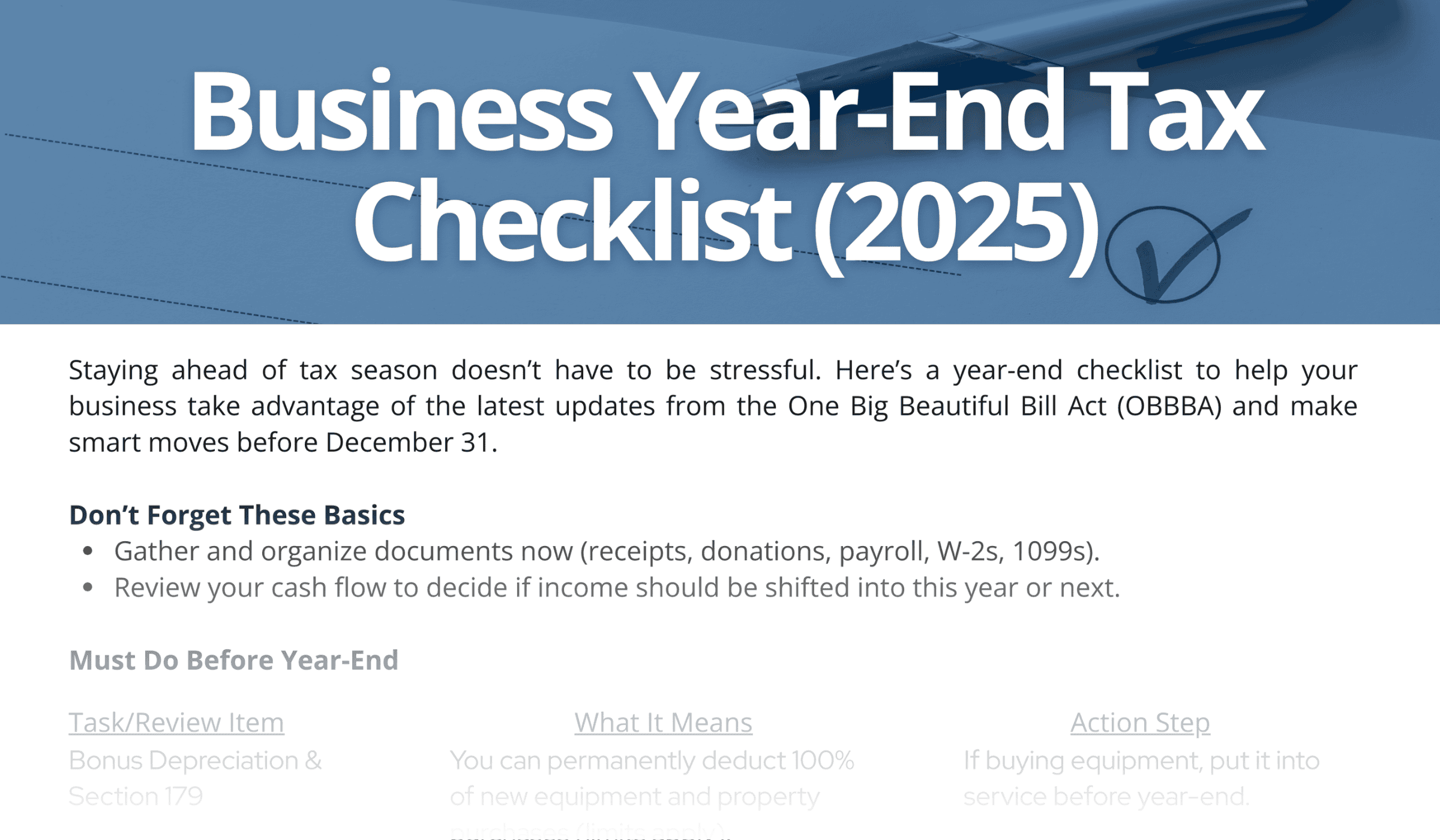

Want to optimize your year-end tax strategy? Unsure if your business is fully compliant?

Our 2025 Business Year-End Tax Checklist walks you through the most important year-end actions to take under the updated OBBBA rules, from bonus depreciation and R&D expensing to payroll reporting changes and estimated tax planning. See how planning today can bring peace of mind tomorrow.

Why It Matters

The 2025 tax year includes significant updates for business taxes. Thus, careful year-end planning is essential.

Proactively reviewing your strategy can help you protect cash flow, reduce unnecessary tax exposure, and position your business for smarter long-term growth. (View our OBBBA webinar from Matt Foley or our OBBBA Tax Guide to go deeper)

In Your Corner

Our advisors work closely with private companies, owners, and finance leaders to navigate complex legislation and design effective strategies. Contact your advisor or reach out to us today to prepare for what’s next. These checklists are a starting point. Every tax situation is unique, so it’s best to review with us or your CPA before making final decisions. Explore LGA’s Client Resources to access guides, forms, and instructions that help you stay ahead in tax, accounting, and business planning.