OUR INSIGHTS

Podcast

The Importance of Policies and Procedures

Blog

Meeting the 606 Revenue Recognition Standard for Contractors

Blog

Deducting Business Interest: Need-to-Know Changes for Real Estate Businesses 2022

Blog

How FIRPTA Affects Foreign Investors Selling US Real Estate

Podcast

Getting Your Administrative Ducks in a Row (part 1)

Blog

Internal Controls for Small Businesses Q&A

Blog

Estimated Tax Payments – Who’s Required, Why, When & How?

Blog

Businesses Can Still Claim the Employee Retention Credit for 2020 & 2021 Tax Years

Blog

Best Practice Series II – Succession Planning for Key Members of Your Finance and Executive Teams

Blog

LGA’s Ken Segal Interviewed About His Career in Business Advisory on the Legacy Podcast

Blog

2021 Year-End Tax Planning for Individuals

Webinar

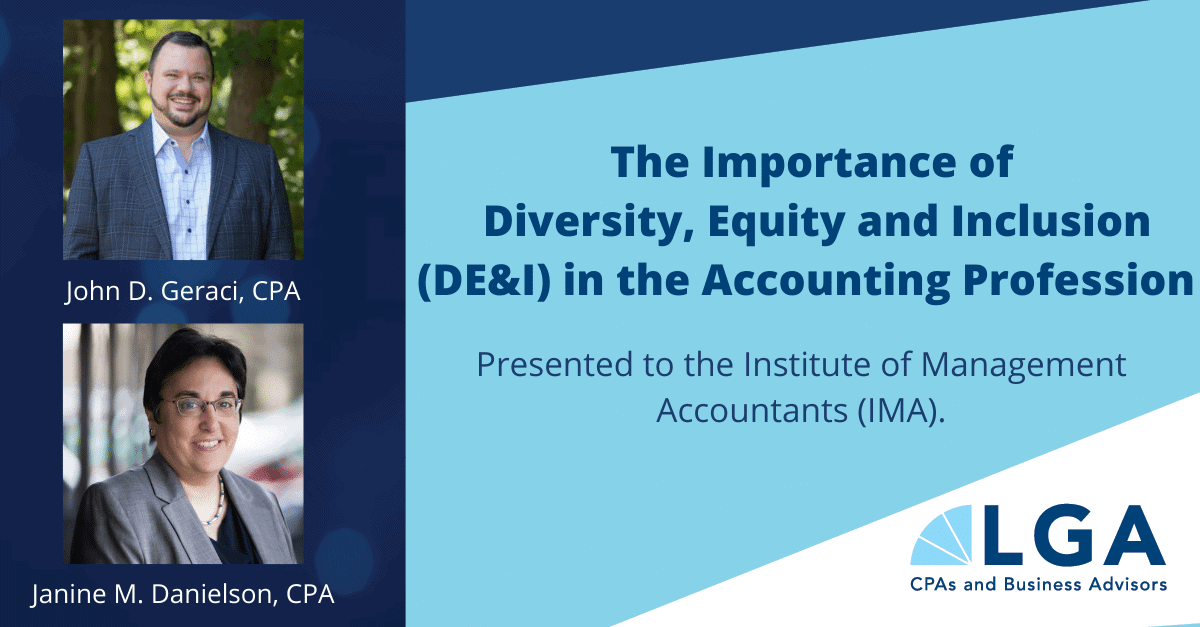

LGA’s John Geraci & Janine Danielson Presented on the Importance of DE&I in the Accounting Industry

Disclaimer:

The materials provided in the Insights section are for general informational purposes only and may not reflect the most current legal, tax, or financial developments. While we strive to ensure accuracy at the time of publication, LGA does not guarantee that the information remains up-to-date or free from error. We recommend consulting directly with an LGA team member to confirm the applicability and relevance of any information to your specific situation.