OUR INSIGHTS

Blog

Growing a Construction Business: Practical Tips for Long-Term Success

Blog

From Vulnerable to Vigilant: Create Your 2025 Business Threat Playbook

Blog

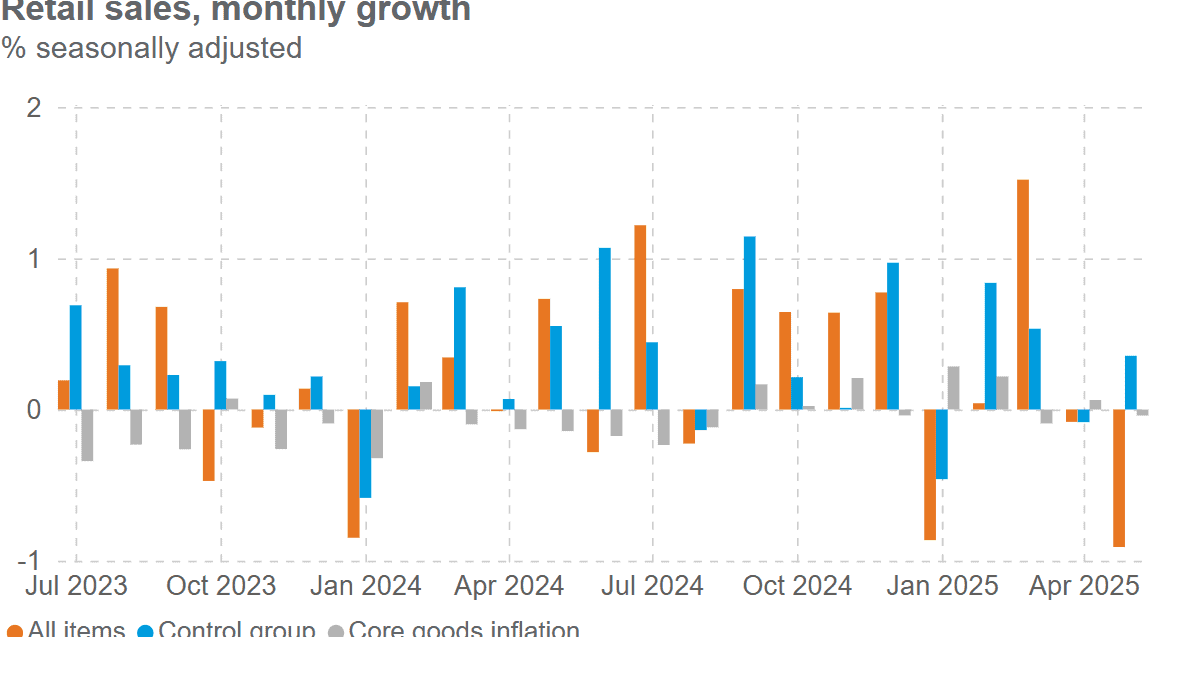

Retail sales send mixed signals amid trade uncertainty

Blog

Is Your Audit Firm Still a Good Fit? Six Signs to Consider

Blog

Fiercely Independent: What Sets Firms Apart in a Consolidating Market

Blog

Smarter Growth in 2025: Turning Uncertainty into Opportunity

Blog

House tax bill aims to counter unfair foreign taxes on U.S. investments

Blog

Top 7 Mistakes Startups Make Without a CFO—and How to Avoid Them

Blog

How to Prepare Your Business for Succession Without Losing Its Soul

Blog

Social Security Fairness Act – What Would Jeff Do?

Blog

Estate Planning Q&A: Charitable split interest trusts explained

Blog

Fraud Detected: What to Do Next to Protect Your Business

Disclaimer:

The materials provided in the Insights section are for general informational purposes only and may not reflect the most current legal, tax, or financial developments. While we strive to ensure accuracy at the time of publication, LGA does not guarantee that the information remains up-to-date or free from error. We recommend consulting directly with an LGA team member to confirm the applicability and relevance of any information to your specific situation.